07 Mar Understanding Carpet Coverage in Residential Strata Insurance Policies

Carpet is a popular flooring option for many Australians, and this is no exception in strata properties. However, most lot owners don’t understand why Residential Strata Insurance policies do not include coverage for carpet damage inside the lot.

Strata insurance is designed to provide cover for common property, shared areas, and building structures.

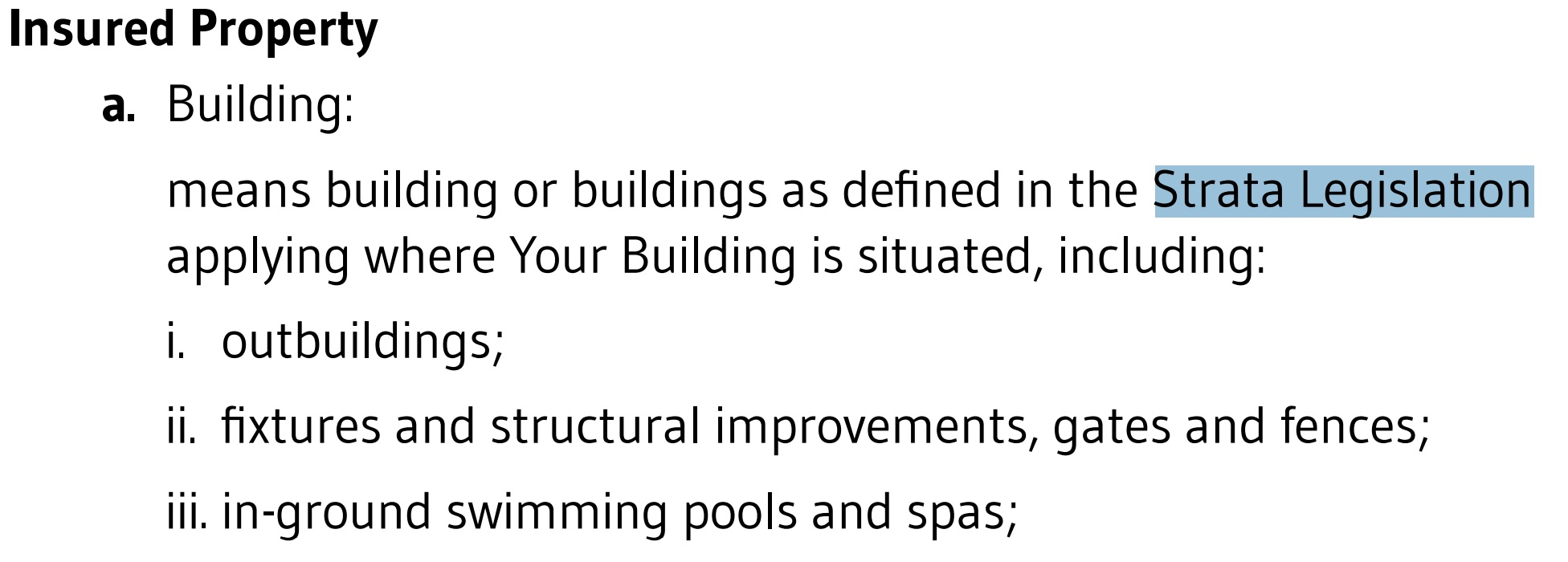

It’s crucial to have a clear understanding of the extent of coverage offered by a strata insurance policy. The first point of a call would be to refer to your insurer’s policy wording and the definition of Insured Property. As an example, we will take a look at the CHU Residential Strata Insurance Policy Wording (QM562-0122). Insured Property is defined in this wording by referring to the relevant legislation applicable to the strata address, as shown in the image below.

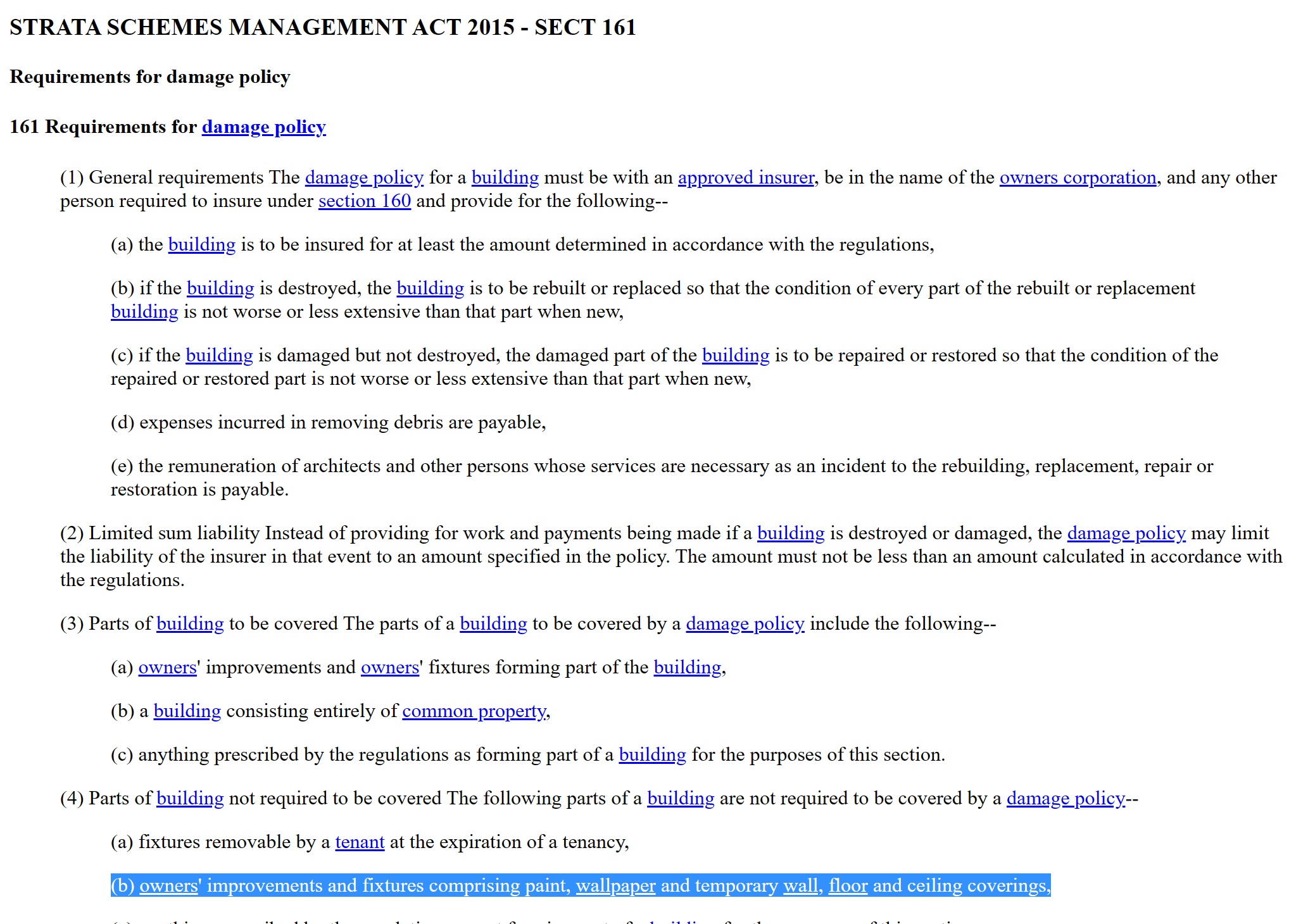

In New South Wales, the section of the Strata Schemes Management Act that defines the minimum inclusions required for compliance by both the Strata and the Insurer is referred to as ‘161’. The following extract is taken from this section’s wording.

Carpet is considered a ‘Temporary Floor Covering’. The CHU policy wording clarifies what is ‘Not insured Property’ by providing a definition as follows.

We then refer to the definition of Lot Owners’ Contents in the policy wording and find ‘carpets’.

In summary, it is important that the lot owner or renter has their contents covered, as Residential Strata Insurance only protects the building, not their personal possessions.

To protect personal belongings such as clothing, phones, jewellery, furniture, TV, laptops, internal carpets, blinds and electrical appliances they will need Landlord or Contents Insurance. By being informed and prepared, lot owners and tenants can protect themselves and their property against unexpected damage and costs.

If you have any questions or would like to discuss carpets in residential strata insurance policies, please do not hesitate to contact our office on 1300 880 494 (Press 2 to speak to our Strata Broking Team) or email [email protected].

Important Notice

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the Product Disclosure Statement (‘PDS’), Target Market Determination (‘TMD’) and Financial Services Guide (‘FSG’), which can be obtained by contacting CRM Brokers or downloading it from the insurer’s website before deciding to acquire, or to continue to hold, this product. Insurance policies issued by various insurers often differ.

Information is current as at the date the article is written as specified within it but is subject to change. CRM Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of CRM Brokers.

The Rising Risk of Tobacco Retailer Tenants for Strata and Property Owners

Earlier this year we wrote an article about high-risk tenants for strata and pro...

03 December, 2024Holiday Trading and After-Hours Information

CRM Brokers wishes you and your family a very Merry Christmas and we look forwar...

04 November, 2024The Importance of Police Reference Numbers for Claims

At CRM Brokers, we are committed to making our client’s claims experience ...

30 October, 2024Are You Underinsured? An insight into how a claim could be affected

What is underinsurance? Underinsurance is a preventable but often devastating co...

27 August, 2024